Entrepreneurial Appetite

Entrepreneurial Appetite is a series of events dedicated to building community, promoting intellectualism, and supporting Black businesses. This podcast will feature edited versions of Entrepreneurial Appetite’s Black book discussions, including live conversations between a virtual audience, authors, and Black entrepreneurs. In this community, we do not limit what it means to be an intellectual or entrepreneur. We recognize that the sisters and brothers who own and work in beauty salons or barbershops are intellectuals just as much as sisters and brothers who teach and research at universities. This podcast is unique because, as part of this community, you have the opportunity to participate in our monthly book discussion, suggest the book to be discussed, or even lead the conversation between the author and our community of intellectuals and entrepreneurs. For more information about participating in our monthly discussions, please follow Entrepreneurial_ Appetite on Instagram and Twitter. Please consider supporting the show as one of our Founding 55 patrons. For five dollars a month, you can access our live monthly conversations. See the link below:https://www.patreon.com/EA_BookClub

Entrepreneurial Appetite

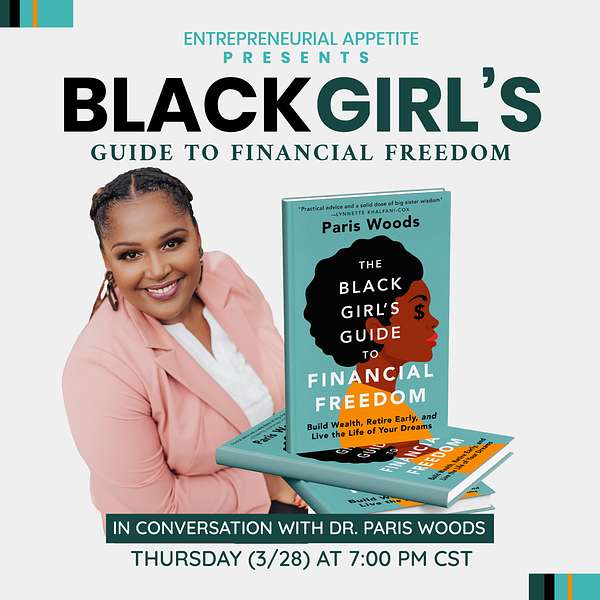

The Black Girl's Guide to Financial Freedom: A Conversation with Dr. Paris Woods

Embark on a transformative journey with Dr. Paris Woods, author of "The Black Girl's Guide to Financial Freedom," and financial advisor Ashley Bailey, as we uncover the secrets to achieving Fiscal Freedom. With Paris's inspiring story as our guide, we travel from her humble beginnings in a single-parent household in St. Louis to a life of purpose and financial wisdom. Our conversation exposes the critical role of education and deliberate planning in breaking the chains of debt, and we challenge you to consider the financial norms that may be holding you back.

Throughout the episode, we dissect proven debt repayment methods like the snowball and avalanche approaches, sharing not just theories but also our personal triumphs and stumbles with these strategies. We confront the societal expectations of car ownership, urging you to rethink what liabilities and assets truly mean in your pursuit of financial freedom. Our discussion is a genuine reflection on the delicate balance between trimming expenses and boosting income, exploring side hustles and the art of amplifying your earnings without sacrificing your soul.

Finally, we chart the course for navigating higher education and investment options with a critical eye, weighing the costs and returns of graduate degrees and the prestige of alma maters. Dr. Woods and I demystify the investing landscape, starting with the low-hanging fruits of 401(k)s and index funds. The episode wraps with an invitation to carve out your unique financial destiny, armed with the insights and strategies shared by Paris, a beacon of financial empowerment whose wisdom can be further tapped into at ParisWoods.com. Join us for an episode that promises not just to inform but to equip you with the tools for a financially savvy future.

Hey everyone, thank you again for your support of Entrepreneurial Appetite. Beginning this season, we are inviting our listeners to support the show through our Patreon website. The founding 55 patrons will get live access to our monthly discussions for only $5 a month. Your support will help us hire an intern or freelancer to help with the production of the show. Of course, you can also support us by giving us five stars, leaving a positive comment or sharing the show with a few friends. Thank you for your continued support. What's up everybody? Once again, this is Langston Clark, the founder and organizer of Entrepreneurial Appetite, a series of events dedicated to building community, promoting intellectualism and supporting Black businesses. And today we have a very special conversation between Ashley Bailey, a financial advisor with Edward Jones and Dr Paris Woods, author of the Black Girl's Guide to Financial Freedom.

Speaker 2:Thanks, nathan, appreciate it Well. First, dr Woods, which let me ask you your preference Paris, dr Woods, which one? You can call me Paris, okay, all right here. So first I wanted to thank you. When I was going through the book and reading it, I personally found several similarities in the journey or our journey. So I myself am going through my own financial freedom journey, so I'm not gonna give any spoilers and specifics, but, like the who you were following, the books that you read, the tools and the resources, the YouTube channel that you mentioned of that family, I was just like, oh my gosh, she knows about them too. She knows about them too, and so the fact that you made this book and all the different things and resource that came together, I think it's very powerful and necessary, which obviously you notice why you wrote the book, but I think it'll help tons of people, if not already, not only just Black women, because, just, I'm pretty sure the countless hours, weeks, months and years to even bring all that together and stumbling across it through trial and error. So thank you for even writing the book and taking that initiative and that bold step to be able to do so. Thank you, yeah, very kind. Whenever I hear feedback from the book. It always like my eyes light up because I almost wrote it for the younger me and the fact that so many other women have found value in the content is just. It's beyond what I could have imagined. So I'm so grateful that I've taken the time to read it.

Speaker 2:Yes, well, I want to start off with kind of the beginning of your story. So of course, people will read the book and be inspired and see kind of where you are now, but obviously and maybe I shouldn't say obviously that was not always the case. So, getting people an opportunity, giving you the opportunity to kind of share what your childhood was like, your experience growing up, that relationship that maybe you did or didn't learn with money, kind of start off from the beginning and let us into your world from, like you said, the younger you. Yeah, so I grew up in St Louis, which is actually where I live. Now Life has come full circle and I'm back in my hometown and grew up in a single family home and you know, when I think back about the things that really stuck with me from childhood, it's a combination of the good and the bad that really came together to give me some perspective on some of the goals I had in life for myself.

Speaker 2:So I did talk about in the book sort of growing up in poverty, and you know we'd experienced a range of financial circumstances growing up. I might have called this working class. For a majority of my childhood, my mom worked. We had a tragedy in our family my aunt was killed, and so I had four little cousins who came to live with us. And so, as a single mother, you know, my mom was killed, and so I had four little cousins who came to live with us.

Speaker 2:And so, as a single mother, you know, my mom was a secretary and she raised six kids on $40,000, which I remember because I was filling out FAFSA for us. And I found out, you know, you learn everything fill out the FAFSA forms, and so, you know, I saw the good and the bad of her trying to make ends meet on a limited salary. I've seen her, you know, crying and trying, you know, writing a list of all the bills and trying to figure out how we're going to pay them. There were times where we, you know, had to leave an apartment because we couldn't pay the rent, times where we, you know, slept in our car or in a family member's basement. We spent time in housing projects. So I feel like I got to see a wide range of circumstances growing up and alongside that, my mother was a woman of faith, she was an ordained minister, and so she spoke life into us and spoke possibility into us and was very intentional about us growing up, thinking that we deserved more, that more was possible, and part of that was her giving us exposure, so sending, trying to find good schools to send us to. We read a lot of books. If ever there was an opportunity to travel, she made sure she found a way to get us on that trip.

Speaker 2:I talk about my first international trip that we had to fundraise for so I could go with the school, and so I think that combination like having her, her character and her integrity as a mother and the vision that she had, is something I really took to heart and I believed her and as a kid you know, I was like this is true. I believe you, I believe hard work is going to. I believe you. I believe hard work is going to pay off for me. I believe education is going to be a ticket out of poverty, and that became true for me and I was able to get a full scholarship to college and really get out of poverty.

Speaker 2:You know, through education it's one of the reasons why I chose a career in education what I sort of realized after you started climbing these stairs and you start to look around and say where did everybody go Like, where are my peers, where are my neighbors? That it's incredibly difficult to escape poverty, if not almost impossible, in this country. Education alone is not going to solve these issues and there's really a hidden curriculum around money that we so often are not taught. And if your parents don't know these things, where else might you get this information? So I think that upbringing it certainly set me up for the future. It gave me a lot, I think, to reflect on and also sort of gave me, I want to say, the space to make some mistakes and learn from them and then to be able to come full circle, like I'm back home now, but also come full circle financially to say here are some of the things I wish. If I can go back to that young Paris, here's what I wish she knew and let me pay those tools and pay that knowledge forward by capturing it in the best way I know how, which was a book. So there's so much I want to unpack even in that one response, which actually flows well with kind of the rest of what I hope the conversation will unfold into.

Speaker 2:We'll walk through the different chapters that you have in the book, and so you mentioned education, which is one of your chapters that you're extremely passionate about. That you mentioned in there, and then also earning, and we'll dive a little bit more, like when you talked about your mom getting creative for that trip One thing that has nothing to do with the book, but you mentioned being raised in St Louis. So people who know about it know about it. Do you celebrate March 14th? I left St Louis at age 18 and I'm just back.

Speaker 2:But I'm getting married and my fiance is 314 day, all day. So I'm here and I'm open to being convinced to celebrate. And, for those who do not know, so the area code, which I don't know if they have more area codes. So my family, both sides, are from St Louis, so that's how I know about it, but the main area code in St Louis is 314. So March 14th, 314 day, literally all of my timeline was my family going and get some kind of Chinese food or whatever the case may be. So when I saw that, to celebrate my birthday, 3-3-0-10. Gotcha, okay.

Speaker 2:So let's go ahead and then dive into the book Again. You mentioned really a lot of different things that you learned and took away from your childhood and education in that as well. So let's talk about the education part of. Okay, you're going to school. Your mom did her best to make sure she can help fundraise for different opportunities. You graduate high school. Now you're going to college. What does that look like? What is that experience? How did you afford to get there? Let's unpack that.

Speaker 2:Yeah, I think the book begins with the first big financial mistake that I made, which was right at this moment. So I did get a full NEPE scholarship to Harvard University, which you know. It's like the sky opened up and manna itself in heaven. Like it was such a huge deal for my family, for my school, for my community, like I don't come from a background of college graduates, much less Ivy League graduates, and so that achievement alone was huge for us and sort of like the pinnacle, like this is what my mom had been working for, with all the work that she put in to make sure we had access opportunities and make sure we could dream big. So what do you do? You know, when you're going to college, you need college supplies, and we went to a lot of different stores around town and we didn't have money for school supplies. But all of those stores offered credit cards and discounts for signing up. And me, as an 18 year old freshly available to sign up for credit cards, sign up for every single one, and that's how I paid for my school supplies. And so while I didn't have tuition, I didn't have school loans. I did walk into college with debt and that was the beginning of my experience with debt. It sort of opened the door to being able to borrow more money. My credit score was great and what I did with that credit score was rack up a ton of debt and so kept those credit cards, charge more, end up buying a car and you know it's like the whole kitten caboodle of debt was possible after that very first little teaser taster of being able to borrow money. So, yeah, I think it was the good and the bad Super excited to be able to go away to school, but also at the beginning of, I would say, a series of financial mistakes and if I can go back and fix them, I would.

Speaker 2:Part of what I'm up to is let me like enlighten folks on things I wish I had done differently. If you're early enough in your financial career to avoid them, but also you know it's possible to recover. If you did, if you pass 18 like us and you did start, you know fall into debt or find yourself in debt today the story's not over. But if you can go back or if you can pass that knowledge on to young people to avoid it, I think we've got to do our best to sort of head this off from the start With that. So, like you said, that was one of the biggest, or rather the first one, the first mistake that you've made and as you started getting a little ahead but kind of realizing, oh, this is a mistake like actually identifying it as a mistake, how do you even get started in like, okay, this is a mistake, now I need to unravel this. So, yes, I need to try to share this with other people, but how do I even get started? What steps do I even take to start to unravel what I have started to do years ago?

Speaker 2:So that wake up call came from me at around age 30. I had achieved all the things I had set out to achieve. Age 30. I had achieved all the things I had set out to achieve. I think I had two Harvard degrees. By that point I was working in education, feeling like I was doing very meaningful work in the world. I had my own apartment and my own car and I had all the things that I thought I should have. And I wasn't experiencing the level of freedom, financially or otherwise, that I thought would be the case, having done all the things that society tells us to do and that I was raised to do. And that's when I came across our friend, dave Ramsey, who I know is controversial and you know people have a lot of feelings and thoughts.

Speaker 2:But I read the total money makeover like in a bookstore love bookstores, love books, as you could tell. And so I just came across that book on a whim and I read it cover to cover and I think it was the first time I realized that it's possible to live life without debt and that there might be other things that are possible for you in terms of freedom, in terms of having more choice and less financial stress on the other side of that debt freedom journey. So that was my light bulb moment and I really set out like tooth and nail to get the credit cards paid off, get the car paid off, get the student loans paid off and sort of get out from under that weight. So that was my light bulb moment. And then began the journey and you know I wanted to get paid off as soon as possible. I know I had been building it by then we're a decade in to creating debt but I wanted to be out ASAP. Once I set that as a goal, I became very motivated to get out of debt.

Speaker 2:So, before actually getting into the logistical how, how you got started you said that you picked up the book Money Takeover or I can't remember the name yes, nate Ramsey book, but I can't remember the name that she just said. But how do you even identify who to listen to versus not to? Because you pick up this book, there's a lot of noise, there's people who contradict each other, people have different philosophies, so you read this, but how did you even know? Okay, this is something that is legitimate, or I should actually listen to. So, yeah, how do you identify who to listen to and what not to, or who not to listen to?

Speaker 2:So I started reading herself finance books in high school, Like a friend's dad gave me a copy of Rich Dad, poor Dad. Susie Orman had a book out then called Young, fabulous and Broke, which was like a financial guidebook. So I owned those and you know, when I walked into bookstores, I would often walk through the personal finance section and read things. So I think I was consuming a lot of different advice and had tried, you know, different things. I think I'd even like purchased a coaching program from you know, the Kiyosaki company, and so I've been trying things.

Speaker 2:There are some trial and error happening as well, and so when I read this book, it felt different. It was different kind of advice no one else was talking about not getting in debt. They're talking about your 20s. Get in debt, that's good, go for it whatever. And this felt different. It also resonated with my experience. I wasn't experiencing what these other folks have promised me, and in the book I heard stories of regular people, people who were working jobs similar to mine, earning income similar to mine, who were experiencing the kind of freedom that I aspired to, and so, like always, I figured it was worth a try. Except this actually worked for me. I was like all right, this is something I truly believe in.

Speaker 2:I think you know, obviously there are some steps to take after this one, but this is what got me into the mindset that I actually can control my money and control my experience of my life and use money as a tool to create a different type of life experience. So it got the ball rolling and really opened my mind to just shifting my mindset around how money works. I think that part is really important is the shift of the mindset, and this is going to be a little kind of, like I said, through the chapters, but also just kind of dialogue conversation. But I think the mindset is really important and people often want to jump to like, oh, I have a couple of bucks and I immediately want to go into investing, or I immediately want to start paying debt off, or really whatever it is.

Speaker 2:Because often we may feel behind and no matter how old you are, no matter where you are in the process, always feeling behind, like, oh, I should have known better, I should be much further along. And how important would you say and I'm just saying that from my point of view how important would you say and I'm just saying that from my point of view how important would you say that mind shift was for you and for others, for them to not necessarily try to skip steps? If you will, I certainly resonate with feeling behind. That might've been the angst I was feeling when I thought I'm looking around at what I think people got going on financially and feeling behind. And now, when I think about the mindset shift, it's a shift away from a focus on accumulating things and I think the angst that I was feeling might have been based on this sort of consumer mentality, like I want to be able to buy, I want to look like expensive, I want to have these nice things so I can show off. You know, and you might never have guessed that was my personality and I've never been that fancy.

Speaker 2:But at the same time, you know you have this awareness about what's going on with other people. If you're feeling behind, it's like behind about what? Like? What do you think this should look like? I mean so, a lot of those visible markers, what we think are indicators of financial health, when oftentimes they are not. So I think that's the first big mental shift is what is wealth, what is financial health even look like? And then to start to think about, well, what are the steps to get there Like.

Speaker 2:Once your vision becomes clearer, once you even have a vision outside of what sort of society makes you think you should aspire to, then you can get motivated to take the right steps along the path to what you really wanna create in your life. And that's a huge mindset shift. And you also mentioned wanting to buy things, keep up a certain appearance and then even going back to you going into college and buying things on credit. As your mind shift changed, how did you start to create boundaries for yourself in how you dealt with credit and debt and also versus how others may suggest it, so people can give you advice, but it's like I know myself I need to set up these kinds of boundaries and use these tactics. So how did you use credit and create those boundaries for yourself after that mindset shift, once I started to feel the empowerment of being in control of my money, like starting to see those dollar signs in the debt column go down, starting to feel some momentum.

Speaker 2:Part of my strategy at that time was also to earn more money, like started picking up side hustles. I think that, like with my side hustle money, I finally cracked six figures and I remember sort of reflecting on that to say like wow, like I could actually make this much money, like I had the ability to generate income, which is powerful in and of itself, even though I was tired. I mean, side hustling to six figures is exhausting and then you start to value yourself and your time a little bit better, which is what happened for me. So you don't have to work 70, 80, 90 hours to hit six figures. We can do better with valuing our time. But I think all of those steps are what helped me start to feel more empowered and to say, actually I have some control of my money in my life and I think that is what made me take the next step, to do the next leg of research, to say, ok, what could be possible on the other side of debt freedom.

Speaker 2:Let me pull this thread a little bit further, even from what Dave was talking about to start to think about some ways to accelerate my progress. Like I love the momentum, I was like let's go faster, let's go farther here and then like what's next? Like once you're on the other side of debt freedom and you have this extra money that you're not paying in debt payment, like what's next? I wanted to be excited about something else and that's when I came across sort of the financial independence movement and started learning about folks who were creating freedom. Right, the freedom from having to work is the way that I think about financial independence.

Speaker 2:There are people who have burnt out from work and they literally want to retire and you know a lot of those folks that you and I both follow have done that. But for me, because I was doing work that was so meaningful like I love my work, I love the impact that I'm able to have it hasn't been about retiring and I have gotten the opportunity to take breaks and many retirements and sabbaticals what we like to call it Right, but really it's about like shifting your relationship to money and your relationship to labor, and I sort of talk about this perspective in the book of my vision for Black women. Like the country has survived off of our labor for generations undervalued labor and what could it look like to flip that equation, for us to highly value our labor so much so that we have complete control over our time, complete control over the work that we do and this can be more timely, just saying about you know the state of Black women in the country and especially in higher education, and so I want us to have complete control over what we say yes to and what we say no to and what we allow and don't allow in our lives, and money is a tool that can allow us to have that kind of freedom. So that became my focus and that helped me move beyond just the conversation around debt freedom to like freedom to financial freedom. Ok, so now let's get into kind of like the logistical how in the book I know you go over different strategies, which I know you talked about snowball method, avalanche method of like the actual steps of getting out of debt. Touch on that a little bit and what those methods are in Consista.

Speaker 2:Sure, the most popular method, I would say, is a snowball method, which is what I used, and the way that it works is that you rank order your debts from smallest to largest. So the smallest debt, that small credit card, whatever it is, is at the top of the list. That's where you focus on getting paid off first, and then you focus all your energy on that next debt on the list, and so you're maintaining those minimum payments as you go for everything. But what happens, and what I really appreciated about it in my journey, was that by the time you get to those debts toward the bottom of the list, you have a lot more money that you're able to put towards those payments, I mean. So you get that psychological boost because you're seeing those debts drop significantly month after month. So it's really it's like behavioral economics, right, it's the psychological boost. So that's why I prefer the snowball method, especially if you have debt that you can get paid off in a couple of years. It'll help you build that momentum and get through it pretty quickly, if not faster than what you thought would be possible.

Speaker 2:The avalanche method works the opposite way. So, instead of rank ordering by the size of your debt. You rank order by interest rate. Then you start with highest interest rate first and then work your way down to the lowest interest rate. So it's a very mathematical approach and I tend to recommend it to folks who have hundreds of thousands of dollars of debt right Like my friends who are doctors and lawyers, and who don't anticipate being able to get through this debt in the matter of a couple of years, and so over longer time horizons, that interest being able to cut down on your interest payments can shave off months, if not years, of those debt payments. So it's a great alternative. It's the mathematical alternative If you can set it and forget it in the background, and you don't need that psychological boost for folks who are trying to get it done much more quickly.

Speaker 2:Yeah, I like the snowball method. I use the same one where I have a mortgage now, but before that I was debt free. But I use the same one and, like you said, it was that boost. It became exciting and became a game to where. Now it became how much can I pay off and how quickly. And, like you said, you can get competitive with yourself whether you're finding extra dollars, whether you're working a side hustle or you start convincing yourself, oh, I don't need to go out to eat today or I don't need these shoes, but you get excited about it because you actually start to see momentum.

Speaker 2:Now what would you say to somebody who and maybe if it is that audience who has the hundreds of thousands where it's just like I'm never getting out Like yeah, yeah, all this sounds good, fine and dandy, thank you very much, but it's just it's not happening for me. Like, what do you say to those people? Yeah, you know, I'm not a CFP, right? I don't work in money, I work in like life. So my question always comes down to what do you want to be true in your life? Like, what are we creating and what are we doing any of this for?

Speaker 2:I certainly hope you're not doing it to follow rules, and you and I came up with right, and you know, for me, the reason that I even started this debt free journey was because I could see the numbers and see at least what I would have in my bank account on the other side of not having these debt payments, and I'd started having some aspirations beyond my current circumstances that I wanted to be able to use that money for.

Speaker 2:So I had a larger reason for it. If all is well and dandy and you're good and you don't have any complaints about your life, like, keep on doing. If it ain't broke, don't fix it Right. But if there is something more than you want, I think deep down for a lot of us it's true, and maybe we don't think it's possible, and so we tend to push down our broader aspirations. But I think once you start to realize that debt might be holding you back from the thing you really want, then it becomes easier to find the motivation to find a way through it, around it, out of it. Dig out whatever you got to do to get to the thing that you really want to have in your life, and I think some of it goes back to what you said before.

Speaker 2:In that mind shift like that being that trigger, that driving force, that being that trigger, that driving force it's not a fad or anything that you saw on TikTok, youtube, instagram. People are talking about oh go, do this, go, do that, go get your LLC snowball method of the avalanche and actually starting to see some wins and allowing that momentum to carry you, because it's not easy which you do touch in the book, though there's some sacrifices, which I want to go into one here just a second about cars. But there's definitely some sacrifices that you have to make along the way, where maybe that's one less girls trip or one less crewing or one less whatever, because you have an end goal in mind. So, going to, like I said, cars, this I want you to share because I thought it was such an interesting paradigm mindset shift of your thoughts on a car and I want you to be able to share your thoughts and your philosophy on that. So, if you can share with the listeners your thoughts on cars, yeah, cars, it's such an interesting topic because and right, I live in the Midwest like we didn't use cars. That's the thing. I think it's very hard to get around if you don't have a vehicle, and I've spent time in other cities I've lived in Boston and other places where public transportation is a lot stronger and more reliable.

Speaker 2:But for folks with backgrounds similar to mine sort of grew up with car ownership as a given. The way I was raised, and the way that a lot of us are raised, is that you buy a car through financing. You go to a dealership this is what everyone does you get financing, which is a loan for your car, and you have a car note that I was raised as a very normal thing. If not, my mom was so proud of me when I got my first car note. I still remember the look on her face like, wow, my daughter can get her own car without a cosigner Right, so it is very normal, which is why this is such a big paradigm shift.

Speaker 2:But what I've noticed is that oftentimes if I talk to folks who want to invest or want to do something else with their money, but they don't have room in their budget, those people often do have a car note right, so the car note is often the thing that's standing between us where we are now, where we want to be. It's standing between us struggling and us having freedom. And so this is where I had to challenge myself to say all right, as I look at my line items and my budget, housing was the first one which I had to resolve, but the car was the second one, and my car the car that I had at 30, was a car that I had brought brand new, walked into the dealership, all of that. I've been paying that car note since 22. And you know, I was eager to get out from under that and to free up that money. And so I knew, once I finished paying off that car, that I would continue to drive it until it died. But then the question comes well, what's next? Are you going to get back into that situation again and have this car note sitting as a bill for the next several years, or are you going to do something different? So for me, that's when I decided I'm not going to be caught in this trap again of having this monthly payment for years and years and years on something that's decreasing in value, right, we call this a depreciating asset, and if you were gonna pick up a financial rule, it would be don't borrow money for depreciating asset, right, if you're gonna have a car, like for those of us who need one, how could we get a car without borrowing money? That, I think, is why that's sort of my reasoning behind my rule when it comes to cars and the mindset shift that I really like push women to consider in the book, like consider what will be possible if you didn't have a car note, and what are you willing to do to make that be true in your life?

Speaker 2:My recommendation is very simple Two rules. One, to always buy used. Because of how rapidly cars depreciate in value the moment you drive it off a lot, it's like throwing cash out the window. And if you're like me, I don't have cash to throw out the window. I have other things I want to do with that cash. So even a car that's one or two years old becomes that much better of an investment for that reason alone. And then the second rule is to pay for it without taking out a loan. I call it paying cash For my young people. I don't mean like actual dollar bills, like debit card, right, whatever's in your checking account.

Speaker 2:Buy used and pay cash are the two rules of thumb that I follow for having a car and it allows me to still be a car owner. And as you get more money, you can buy nicer used cars. If you don't have any money, you might be buying a not nice used car, but money you can buy nicer used cars. If you don't have any money, you might be buying a not nice used car, but you don't have to be in debt. And it allows you the freedom then to make other choices, choices about your future investing, growing money, getting your money working for you instead of decreasing your value sitting in a car, and really have you put you in a position to look out for your financial future instead of sort of throwing money down the drain on a depreciating asset in the present. So to clarify and make it clear, that in one of the sentences you did say was, like you said already, pay cash or, if I recall correctly and correct me if I'm wrong well, I don't have the cash to buy the car outright. Well then you can't afford a car. Is that correct? That's what I said. So that was like.

Speaker 2:When I read that I was like, oh dang, you know, if ever anyone was going to get upset and I haven't I. Sometimes I watch the reviews and people are mad at me. So I think they're listening and saying, hmm, let me think about this. But I've met enough women struggling financially, like really struggling to be able to do what they want to do, and nine times out of 10, more than nine to almost 100% there's a hard out sitting there. So it's just real and it may feel like a sacrifice at first.

Speaker 2:Now, when you're on the other side, you're experiencing freedom, you can say wait a minute, that was actually a good idea. Let me pass this advice along. If you're sitting in a space where it feels like a challenge, I would really challenge you to take me up on this advice and see how it feels once you're out of debt, once you're experiencing financial freedom. Was it worth it to make that short-term sacrifice on the car? So what about the person who's listening and is like, oh okay, well, thanks, paris, I would have loved to have heard that five years ago, before I got my car. I already have a car, I'm already in debt with a car note. So now what? Yeah, that's where I was when I started my journey. You know you have choices. You can add it to your debt snowball and say, all right, I'm gonna get this paid off. Or you could say I'm gonna ride this out until I'm done with the payments and I'm going to keep driving this car and see what it feels like not to have a payment and still and to drive a paid off car.

Speaker 2:So I think it's going to come up to how quickly and what your goals are. What would you be doing with that money if you weren't putting it towards your car note every month? And then, how quickly do you want to get there? Right, and so the reason, at least from my view, how this part came up was you mentioned sacrifices earlier, and so that being one of the sacrifices. And so there's two sides to the equation when you're trying to reach financial freedom, one side being reduced expenses. So get rid of your car if necessary. Only buy cash. Don't carry a car payment. Get rid of debt and then raise your income. Don't carry a car payment, get rid of debt and then raise your income.

Speaker 2:So you mentioned your mom getting creative to raise money for a trip. You also mentioned you getting creative in side, hustling your way to six figures. Let's touch on that a little bit of how can others increase their income. What were some of those hustles that you use to get to six figures. I started doing some consulting. I think it became saying yes, when people started offering like an opportunity, would you like to do a few hours here, participate in a program, do you want to return as a coach? So things like that for sure.

Speaker 2:And then when we talk about thinking creatively how to reduce the car payment, which is often number two on our budget, but that housing payment is a number one, and so I told you I was eager and motivated to get out of debt and I don't think of a mortgage, as it's not the debt I'm talking about Right Like mortgage is great because it's an appreciating asset and it's growing in value over time. So if you're going to borrow like a house, you know has been very helpful to me over the years home ownership has, and then their first house was a strategic purpose. So I very specifically found a house that would work for Airbnb. I had a master suite in the back that made it easy to just put up a door and a lock and have it be its own separate suite with a separate entrance, and I used that. So that became a side hustle as well my Airbnb business right out of the house. The money that I brought in from that totally covered the cost of my mortgage. So, mission accomplished, sort of crossing that off and then letting me have more money to put toward that payoff. Right, like I was very clear, like I'm eliminating this in my budget for a very specific purpose and for me that was getting the debt paid off. So it just became whatever I can come up with, saying yes to people who want to pay me for things, and then getting creative with the resources that I had and saying how I could generate money with what I'm sitting on.

Speaker 2:One thing I did like about the creativity and to your point that you mentioned in the book was at some point you had gotten laid off and somebody reached out to you to do a similar job full time, but you said no. But is that a consulting gig that you mentioned? Yeah, that's a little bit later while I was writing the book. So past that age 30, it's space. But yeah, yeah, it's like people are often looking for help from smart people saying yes or counter offering or something. So here's what I will do. What do you think? Like you want to hire me for a job? I'm not looking for a job right now, but I'll sign up as a contractor and make some money that way. I thought that was really cool and, to your point, it's creative. Like you said, where it was just like. I'm not going to do it from eight to five, nine to five, full time, but this is what I am willing to do, what I can do. So, even if you are already working a full time job, you can, like you said, get creative and maybe do consulting of something else and not trying to juggle two, which I've heard some people trying to juggle two full-time jobs. But to your point, just being creative.

Speaker 2:You mentioned in the book, if I recall, like mobile notary I know that that's picked up in the last couple of years so increasing of your income and the decreasing of the expenses Now attached to increasing of your income. One of the things that you mentioned is, for lack of a better phrase, like, well, I'll just say from switching from one job to the next, basically, and realizing you were being underpaid for your skill set. Can you touch on that some? Yeah, this was an important moment for me as well, once I realized how much I was working in the side hustle lane, how much I was able to generate. And then it got me thinking that, plus, I read another book, because I love a good book.

Speaker 2:I read a book called your Money or your Life by Vicki Robin, and she makes you calculate how much you're trading an hour of your life for financially. And by the end of the book you start to realize like my time is incredibly valuable. It's like the one resource we literally cannot get back, and if I'm going to trade it for money in the form of a job, I need to charge a premium for this very valuable asset that I have, which is my time. And so it really challenged me. It started challenging my thinking, so it was a mindset piece.

Speaker 2:And then I met a woman who was doing a very similar job to me and was earning significantly more than I was. And that experience of meeting someone in the flesh who was a Black woman just like me, working in education just like me, who was earning so much more, it showed me it was possible and I didn't have any excuse then to continue to work at the level I was working, and it sort of got me on this journey of asking for more, like expecting more value in exchange for my time and starting to work my way up the salary ladder. I didn't have to shift careers, but I did start to have to value my time more and start paying attention to the things I would say yes to, career-wise, and things that just weren't going to be worth my time anymore. What comes to mind basically for what I think about that and if I'm somebody listening to what you're saying, having a fear and concern, or maybe even the audacity to command and ask for more, where it's like, yeah, I see somebody else and, yes, I may have met somebody else, but that's for them, not for me. Did you have anything like that or was just the book and the other person enough to empower you?

Speaker 2:I'm not so familiar with CliftonStrengths, but one of my strengths is competitive, which I've been reflecting on. I'm like, what does this mean? I feel like I'm a team-oriented person, but it gives me like. First of all, I have an awareness of like what is happening. It helps me be good in groups because I have an awareness of what's happening around me. But when I think about meeting someone, it sort of opens up what's possible. If I think we're similar and if you can do it, I have no reason to think I can't. So that's part of my personality, like it's very inspiring to meet someone killing it in any domain.

Speaker 2:So I'm like, oh girl, I can do it too. Like hey, like I'm motivated now, so I think that helped me. And even at the next salary level, like with each step, you have that same fear Like well, can I make the next step? It's been helpful for me to talk to people like get in community with people who make what you want to make. Like get around people who are living this life, because first of all, you realize they're regular people, like there's nothing special about these people, but then you can ask them like how did you get that job? Like what were the steps that you took? What were the tools that were helpful for you? Like really pick up the strategies too. So it's not just shooting in the blind, you know, in the dark, or not, just going to your current boss and saying I think I deserve double now Right, but it's like actually there are strategies that you can use that people have used, and so it's just, I think, once you realize it's possible, then taking the steps to say okay, well, how did you do it? And then do it too. So some of the steps you said were meeting the young lady or the woman who was in a similar profession, the book and exposure.

Speaker 2:One of the things you also mentioned in the book was glass door. Can you share how you use glass door or what glass door is for people who may not know about that? Yeah, I love glass door because it shows you real salaries, that people at real companies, a real role, so you could look at a company, let's say a role you're considering, type it in there and see what the range of salaries reported are. So it just equips you with more information so you're not going into roles blind and I think a lot of people their worst. The question they dread is what is your salary expectation right? And the way you can counter that is by doing your research ahead of time to know what the expected salary range is Like. I'm never going gonna answer that question blind. And you get to a certain point where you actually need to know the salary before you apply because again we're starting to value our time differently. So once you realize where your time is worth, I need to know upfront, before I trade any of my time, even applying, if this job pays what I need to make. So that transparency through Glassdoor and through having conversations with people to understand, like, what is your skill set commanding in the market, who's paying top dollar for what you have to offer. So you're aligning your expectations and aligning your time with people who can actually afford you.

Speaker 2:And another thing that I wanted to touch on with increasing your earning ability is leveraging education, so going into your passion and you talk about which. I don't know if we'll be able to go all the detail, but I was thoroughly impressed with the ways that you basically describe how you can get your education for free and I was like literally, I mean we hear like, oh, scholarships and grants, but like you literally walk through like no, here are some places, here are some organizations, here are some sites, here is some scholarships and where you can find them. But if you can kind of talk about the importance of the education piece and how that can be leveraged to further increase your earnings, I love the education chapter I had to set up because my career is in education, so I definitely spent a lot of time on that one. I think like one of the first things to consider and this is another mindset shift, like when we think about going to college, how does one pay for this? Well, you take out loans. That's just what everyone does. Could it be possible to go to school without taking out loans? And my perspective is a hard yes, and so I provide a lot of pathways for how to do that, whether going to a school with a lot of need-based financial aid, like if you're poor it's free, which is what I did, and there's a list of schools that are free if you get in, just because they value socioeconomic diversity, when it's schools that meet 100% of demonstrated need. That's like the key phrase to Google and you can get this list of colleges. It's around 75 schools that meet 100% of what your family needs, so you can attend. So start to think through some of those different pathways and then you know, at the end of the day, reminding us that we're the consumer and that these institutions are businesses who want our money and want our business and being able to shop around and say what are you offering me in exchange for my money and cost compared, just as we would do any other shopping, like putting on your financial hat. When it comes to looking at colleges as well, to see what are they offering you in exchange for what they're asking. So that's the college piece.

Speaker 2:I did want to draw some differentiation between how we approach college versus graduate school, because this feels like the next biggest mistake that I so often see folks who went to college because we know college, like a bachelor's degree, opens up just the next set of jobs. But we assume, just because a bachelor's degree is so helpful, a master's degree must be the next best thing, a master's degree in anything, and that's simply not true. And also one of the mistakes that I made financially I mentioned. I went to college for free my master's degree. I flipped it and took out $60,000 in loans for a master's degree, which is one of my regrets, like when I hit 30 and I was paying off that debt. The majority of it was my master's degree loans and so it behooved me to figure out because I love school, like I'm definitely a nerd's nerd and will be in find some way to be doing somebody's program. So I knew I was going to be doing another degree to start to think about well, how could I be smarter about pursuing my education, still get the value but not set myself back financially? And I did that.

Speaker 2:I followed the advice in the book and really did sort of the cost benefit analysis for this doctorate that I did, considering schools that would be free but where I have to stop working, schools where I could afford the tuition if I just paid cash. That's what I encourage folks to do, like if you're grown enough to be looking at graduate school, you should be able to run a cost benefit analysis Is this helping me make more money? Is this advancing my career? The money I'm putting in, how quickly am I going to get my money back? Those are the conversations we should be having beyond a bachelor's degree, and one of the things that I did appreciate about what you mentioned in the education aspect of the book was basically again outlining literally the different types of scholarships and the needs-based opportunities that are available, because there is also a mindset in the philosophy of the prestigiousness of your school matters, and you, like you, said full ride scholarship to Harvard.

Speaker 2:So you don't have to necessarily think, oh well, these schools or these opportunities for me to have my education fully paid is gonna be a school that nobody really knows or nobody really cares about, which, and even if so, the school I graduated from. If I told y'all, y'all probably wouldn't know anyway. But you know still, I got the information and the knowledge that I needed. But for those people that were that matters. Where it's like that name on my resume or you know that work matters, there's still opportunity there. So I thought that that was really good and helpful for people to be able to know and take away things from that Likes. And I see that you caught back on, are we almost?

Speaker 1:We almost there. Okay, if you got one more thing you want to get at, you should get at it.

Speaker 2:Okay, got you Okay. Well then, what I do want to jump into then is the investing piece, and I know that that can be so big and broad, and so what I will do is narrow it down to at least how did you say that you got started? The simplest way that you got started with investing, where you've already walked through these steps, like we talked about before mindset shift. Don't skip steps Now you are ready to start investing. How did you get started and what did you do?

Speaker 2:401k I think most of us have access to something through work. If we're putting money in it at all, we just let them take care of it. That's what I hear from most people, so I think that's the best place to start. It's an account you already have, easy to open just by signing up at work, and a great place to start your practice, to take a look at how your money is being invested, and I will share my favorite investment is the index fund, so that's something I would definitely recommend folks research as a safer way to invest for the long term without trying to pick individual stocks, and especially if you're not the kind of person who wants to be watching the stock market in and out every single day, buy tools that work for your personality and for your lifestyle, and the index fund is one of my favorites, and that was one of the things that I had as a question, given time allowed is how often should I be checking it? Should I watch it all the time? How concerned with it should I be? But you just touched on that. If that's not your personality and you don't have time or interest to do that, is to stick it in. You know those funds and in the book you also mentioned like target funds in your 401k. So I will. I do.

Speaker 2:We'll say one last question before I pass it back to you, langston. So now that you are, what I will say, kind of on the other side in that financial freedom realm, how are you now living in your freedom and basically living on the other side of that? Like what does that feel? Like the best way I could describe it, I have to remind myself what it feels like to experience a financial emergency, because that's simply not the life I'm living right now. It's like, oh, the car needs something to be fixed, I can pay for it. Or oh, my sister needs me to fly in to help with the boys, I could book a flight today and head down there. So I don't think of myself as living a fancy life and driving a Lexus or whatever you describe as something fancy. I describe my life as the freedom to make the choices that I want to make and to do the things and spend time with the people that I value the most, and that's what I aspire for every woman who reads the book, and I think that that is a beautiful thing. I think that is a good way to finish it off.

Speaker 2:Now you do go into the book on literally how to dream, like literal steps for people to walk through, for them to again change their mindset, to be able to dream, the importance of dreaming. What do you want to dream, like you said, really, what's the why behind all of these? So make sure y'all do pick up the book. There's way more details. I would definitely continue to keep talking, but we obviously got to respect everyone's time of this evening, so thank you again. So much, paris. Definitely appreciate it. I've enjoyed it. We'll love to continue to just connect with you, even outside of this. So I will pass this back to you, langston.

Speaker 1:All right.

Speaker 1:Thank you both for the insightful conversation.

Speaker 1:I want to give the audience an opportunity to type their questions in the chat or the Q&A, and we will try to get as many of those answered as possible, and so to give you all time to do that, paris, I want to ask a question, as folks in the audience are getting their ideas together or whatnot.

Speaker 1:You know you were able to write this book while you were in graduate school and talk about what that was like. But then for people who are stuck saying that they don't want to get their doctorate because I'm trying to recruit doc students where I work right now and the hardest thing is to get people to leave their main job right, which gives them benefits and all these other things that they've got going on Maybe they have family responsibilities, but how are you able, once you recognize that your master's degree was somewhat of a financial mistake, but going into your doctorate? What was the approach that was different there, and what advice would you give to people thinking about getting their doctorate, not as something that they just want to be called doctor, but they're really interested in furthering their education as something that they value?

Speaker 2:Yeah, I had to do that cost benefit analysis for myself. And what do I hope to gain in exchange for this degree? Is it helping me make a pivot in my career? Is it helping me access more money? Like, what am I getting out of this?

Speaker 2:And for me, the doctor was truly an intellectual pursuit, because I left school because I wanted to go deeper on a topic of interest to me, wanted to conduct research that benefits the Black community. This is what I knew to be true. It didn't make sense for me to give up my job to pursue this. I was making a lot of money and I stayed in my job while doing the degree, and so that's, you know, the calculation that I made, and someone else might make a different choice.

Speaker 2:I had the co-founder of the nonprofit that I started in New Orleans with full time to do her PhD in sociology. So we sort of took different paths, and for her it wasn't about money, it was actually she wanted to transition into becoming a professor, like really wanted to take a true academic path, and so this was a career move, like being a PhD student was a career choice in and of itself for her. So I think that's the level of analysis that people need to do, and that's what I did and realized that actually this is I'm going to be a practitioner, I'm going to continue to work in education, I'm not going to shift into being an academic. And so I did a practitioner focused doctoral degree and I paid for it.

Speaker 1:I didn't take time off from work. Thank you for those insights. And we do have one question in the chat from Keisha Blocker. From Keisha Blocker and she says as someone in a career transition, I've had an opportunity in my current career path and my current career path open up as a side hustle. Would either of you recommend a financial investment into furthering my education in this field? So I think basically the question is is like, at this transition point, what's the calculus for investing in education necessity to actually like launch the side hustle? If I understand the question correctly.

Speaker 2:Here's what I'll tell you is true of women. We often think we need another degree, another credential, someone else to give their stamp of approval before we go do the thing we really want to do. And so I would pause and have you ask yourself that, like are you looking for someone else's validation or is it a credential you actually need to access this field? Like, if you're transitioning to nursing, you actually need a license and you you know you want to be a lawyer, right? Or is it just that I want to have more training or another course? I want people to believe I can do this job. In which case, what I was excited about seeing your question was that you can start to build experience through a side hustle, like build your resume, build your credibility by doing the work and by proving what you can do, versus trying to go get an outside stamp of approval from education, which experience trumps education? Like, I'm always going to want to know what have you done, not what is your study in a book what have you done?

Speaker 1:not, what is you study in a book? All right, keisha, thank you for that question, and we're going to wrap up with this last final question for you, paris, and that is, if there was an additional chapter of the book or some extra content you would have put in there. What is that thing that you would have added?

Speaker 2:There was some more stuff in there that got cut and edited. I think one of the topics I end up talking about a lot is home ownership, so a lot of folks are interested in this and I've had some good experiences, and also I'm not a 100% believer. I don't think everyone needs to own a home, so I think there's some nuance around that discussion. So if I had the space, I would have opened up that conversation for us too.

Speaker 1:All right, and before we wrap up, Ashley, we'll start with you If you could say where people can find out about what you do and your services as someone who's working as a financial advisor with Edward Jones and then Paris. We'll wrap up with you talking about where people can follow you and purchase the book.

Speaker 2:Yep, so I'm on LinkedIn as well as Ashley Bailey. Yep, so I'm on LinkedIn as well as Ashley Bailey. Also, website wwwedwardjonescom forward slash Ashley dash blocker. Blocker is my maiden name, so I'm married now, so website and LinkedIn. Full service financial planning, certified financial planner so that's where you can find me Awesome. And ParisWoodscom is my website. Drop it in the chat. And author Paris Woods is my handle on all social media.

Speaker 1:All right. Thank you both for joining us today and I appreciate you. Thank you for joining this edition of Entrepreneurial Appetite. If you like the episode, you can support the show by becoming one of our founding 55 patrons, which gives you access to our live discussions and bonus materials, or you can subscribe to the show. Give us five stars and leave a comment.