Entrepreneurial Appetite

Entrepreneurial Appetite is a series of events dedicated to building community, promoting intellectualism, and supporting Black businesses. This podcast will feature edited versions of Entrepreneurial Appetite’s Black book discussions, including live conversations between a virtual audience, authors, and Black entrepreneurs. In this community, we do not limit what it means to be an intellectual or entrepreneur. We recognize that the sisters and brothers who own and work in beauty salons or barbershops are intellectuals just as much as sisters and brothers who teach and research at universities. This podcast is unique because, as part of this community, you have the opportunity to participate in our monthly book discussion, suggest the book to be discussed, or even lead the conversation between the author and our community of intellectuals and entrepreneurs. For more information about participating in our monthly discussions, please follow Entrepreneurial_ Appetite on Instagram and Twitter. Please consider supporting the show as one of our Founding 55 patrons. For five dollars a month, you can access our live monthly conversations. See the link below:https://www.patreon.com/EA_BookClub

Entrepreneurial Appetite

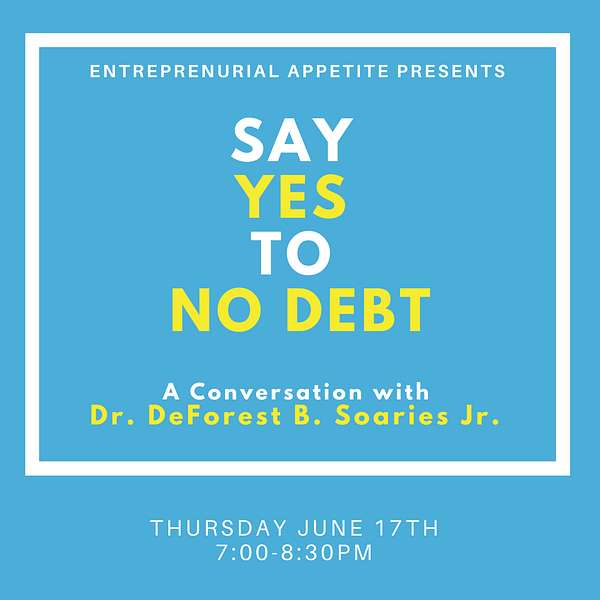

Say Yes to No Debt: A Conversation with Reverend Dr. DeForest B. Soaries Jr.

Uncover the blueprint for financial freedom as Reverend Dr. DeForest B. Soaries, and I take you on a journey through the intertwining paths of social justice, church influence, and economic savvy in the Black community. Together, we explore the profound impact of the Black church's role in nurturing not only spiritual but also fiscal growth, providing support and scholarships that continue to propel young minds into their future successes. As Father's Day approaches, we examine the long-standing tradition of church scholarships and their testament to the commitment of congregations in fostering the aspirations of high school seniors.

Venture into a heartfelt discussion where personal narratives meet community triumphs. I share my transformation from a civil rights activist to a champion of financial empowerment, revealing the life-altering realizations about the importance of living within one's means and contributing to our community's economic independence. Reverend Soaries and I dissect the conventional wisdom on debt, breaking down the crucial differences between what hinders and what helps in building wealth. We also celebrate the extraordinary philanthropy of Pastor Thomas Boyd, whose disciplined financial management serves as a beacon of inspiration for Black communities.

This episode isn't just about acknowledging success; it's an empowering dialogue designed to equip you with the knowledge and strategies for creating your legacy of financial freedom. We tackle the cultural shift necessary for educating our youth in financial literacy through innovative methods, including gaming, and underscore the critical role of small businesses in uplifting Black communities. We also address the complex landscape of student loan repayment and provide insights into navigating the path to influential boardroom positions. Join us for an enriching experience that will leave you with both the celebration of cultural achievements and the tools to forge your economic destiny.

Hey everyone, thank you again for your support of Entrepreneurial Appetite. Beginning this season, we are inviting our listeners to support the show through our Patreon website. The founding 55 patrons will get live access to our monthly discussions for only $5 a month. Your support will help us hire an intern or freelancer to help with the production of the show. Of course, you can also support us by giving us five stars, leaving a positive comment or sharing the show with a few friends. Thank you for your continued support. What's up everybody.

Langston Clark :Once again, this is Langston Clark, the founder and organizer of Entrepreneurial Appetite, a series of events dedicated to building community, promoting intellectualism and supporting Black businesses. And today we have our very first throwback episode, which features a conversation with Reverend Dr. DeForest B Soaries. He is the author of Say Yes To No Debt: 12 Steps to Financial Freedom and the founder of the D-Free Financial Movement. And this episode is special because April is National Financial Literacy Month, so we thought it would be appropriate to share with you one of our most downloaded episodes about personal finance and business about personal finance and business.

Langston Clark :Pastor Stories was the pastor of the church that I grew up in in New Jersey and one of the things that I love about growing up at First Baptist Church of Lincoln Gardens in Somerset, new Jersey, is that it was a church that was deeply rooted in the community that it was in, and one of my fondest memories maybe not so fond is that Pastor Soaries would always invite the students to bring their report cards up.

Langston Clark :He did not care about the FERPA laws, he wanted to make sure everybody was getting good grades, and at the time I wasn't the best student, but nevertheless I still got a scholarship from First Baptist Church to go to college, and I had the opportunity to go to North Carolina A&T, in part because of their support, but that's that's the place where I became much more into intellectualism and a better student. And so First Baptist Church of Lincoln Gardens is a big part of my journey, academically and professionally, because now I'm a college professor. Academically and professionally, because now I'm a college professor, and the culture that I was exposed to at the church is a huge part of making me who I am today. And so, before we begin, I'm going to let Dr Soaries, past Reverend Dr Soaries, introduce himself and make you all familiar with the D-Free movement.

DeForest B. Soaries Jr.:Thank you for those introductory remarks. It's quite humbling to see you all grown up. You know we had our unique registry. We call it the jam. I'm not sure we could call it jam today because the culture has changed, but back in those days, you know, to go to a jam was either like a jazz jam session or a Saturday night party. So we just took the concept from the culture and we turned the J. I went to Jesus and me and you wanted the active young people in Jesus and me. The Michael Pennix was our leader and so many young people came out of that ministry. But the whole point was then as it it is now making churches in general and Jesus in particular relevant. You know, every generation has the obligation of making the culture address the contemporary needs of the community and every church has an obligation to the community to be a resource for the community. And if you recall, a good portion of the young people who came to jam weren't members of our church. Yeah, and we didn't distinguish between church members and non-church members who were just jamming for Jesus together.

DeForest B. Soaries Jr.:I started jam back in the 1970s and I brought it with me to First Baptist and the people responded. But long before I got to First Baptist. The church had a tremendous commitment to young people through traditional and nontraditional programs and activities, and I just tried to build on the foundation that I inherited when I got there. And you caught me just in time because I'm 13 days away from retiring. Congratulations and thank you so much. June 30th I will retire after having been senior pastor for 30.6 years and it's been a great run and it's time for me to step aside and let a younger man come in and take the church to another level. But I've always had a commitment to spiritual growth, academic excellence and economic empowerment. We have scholarships. This Sunday coming it's Father's Day. We're awarding high school seniors with scholarships to members of the church and I'm just so happy that you were able to experience a positive connection to the church and carry that with you to our junior career. Definitely.

Langston Clark :So I want to talk because you highlighted a little bit the scholarship fund and we're going to get a little bit more in depth about Say yes to no Debt and the D-Free movement, just generally speaking, because I guess from my generation I'm an older millennial there had been some critiques about the Black church not being relevant to social justice issues or even economic issues that face Black communities. So I'm wondering if you could talk a little bit about, from your perspective, what role does the church have in supporting and sustaining the economic liberation of Black communities?

DeForest B. Soaries Jr.:Sure, I think the church is central to the possibilities of black people and the church has an obligation to address holistic needs that black people have. You know, one of my academic mentors at Princeton, where I did my master's degree, was Dr Peter Paris, and Peter Paris wrote an important book called the Social Teaching of the Black Churches. And without even reading the book and it's a profound book it talks about how black churches have interpreted scripture to aim at justice issues and economic issues. But if you look at the name of the book the Social Teaching of the Black Churches what it does, it informs us that there is not one black church, and so when you talk about a critique of the black church, you have to distinguish between the various types of black churches. There's some black churches that are so fundamentalist all they care about is helping people get to heaven. There's some black churches that are led by men who have convinced people that if the people make the preacher rich, then God will make the people rich. You know they're better known as prosperity gospel.

DeForest B. Soaries Jr.:And then there are churches that are in the mainstream tradition of the African-American church, where the black churches were started in response to injustice.

DeForest B. Soaries Jr.:There wouldn't be a black church. Had there not been racism, there wouldn't be a black church, had the white Christian churches not treated black Christians like second class citizens. And so the black church was born in protest. It was born in response to racial injustice, which means that, if we're going to be true to our tradition, true to our founding, true to the God who used the black church as a kind of arc in response to the tidal wave of oppression, that today we would pick up the mantle of the historic African-American religious tradition, speak truth to power and remember Jesus said that he was anointed to preach good news to the poor and set captives free. And so D-Free, specifically as a ministry that grew out of First Baptist Church, is a ministry that's designed to speak truth to power and good news to the poor. The good news is that poverty is not a curse. Poverty is an economic condition that can be addressed strategically, and so we deal with both systemic and individual causes of poverty, and we help people overcome both.

Langston Clark :That's good. One of the things that you talked about dealing with people in poverty I remember watching you on CNN's in the black church a few years ago and there's a difference between being poor and not being wealthy, right, Because we have lots of middle-class black folk who still don't have the wealth that our white counterparts do, and maybe we should even make those comparisons. I don't know, but the reality is is that there are middle class black folks struggling with their finances. So can you talk a little bit about how we have more of these conversations like across sort of the economic diversity of black communities?

DeForest B. Soaries Jr.:Yeah, I distinguish between middle class and middle income. In the first instance because a lot of and it's a third of black America is middle income. But if you don't have assets that exceed your liabilities, if you've not inherited assets from previous generations, if you don't have a home ownership or equity in your home, if you don't have homeownership or equity in your home, if you don't have savings that you're able to keep to the side and use for emergencies, then you're not going to create wealth. And so the black experience is such that listen, we celebrate on Saturday Juneteenth.

DeForest B. Soaries Jr.:1865 was not that long ago, but 200 and some years prior to 1865, black people worked for free. So if my family has been working and getting paid for 250 years and your family has been working for my family and I'm not paying you, I'm getting paid double and you're getting paid nothing. So, 150 years after slavery, we find these economic disparities that are rooted in the history of our real experience, and today it's exacerbated by the disparity in incomes. I mean, all the data suggests that the odds are against black people. However, the anecdotal data says that defiance, we can get a roadmap for discovering possibilities for wealth ourselves.

Langston Clark :Absolutely so. Talk a little bit about the D- Free origin story and how you were able to get that in place at First Baptist Church and then get it to spread in some other Black institutions, maybe even outside of the church.

DeForest B. Soaries Jr.:Well, sure, I was trained by Jesse Jackson to be a civil rights activist. That's my roots. Dr King was killed April 4th 1968. I was a junior in high school. I decided that day that I was going to dedicate the rest of my life to helping black people. At that point I thought I'd be a lawyer and help black people by defending them in court, but as God would have. But I took a different path and I decided that Jesse Jackson was the best follow up to the work Dr Ching had been doing in the 1960s.

DeForest B. Soaries Jr.:Now, in the early 1970s, what Jesse Jackson's message was this the civil rights movement is over, and it's over because it won. We won all of the victories that the civil rights movement was crafted to address. And what Reverend Jackson was saying in the early 1970s was therefore the next movement has to be economic. We have to learn to leverage our financial power and only support those companies that support us. We have to pool our resources and form our businesses. His whole, his message was so honed and so focused on on money, Langston, that here was his line we have to go from civil rights to silver rights, and as a young guy coming out of college, I was attracted to that. I said exactly that's me. So I went to work for Reverend Jackson and what happened after two or three years was I felt myself being sucked more into protest than development, and I felt that we were trying to keep the civil rights movement alive and just use different language.

DeForest B. Soaries Jr.:And I needed two things. First of all, I needed to stop living a lie, because while I was doing all that activism, I think your generation would say I was woke. I mean, I was woke, but I was broke. I didn't save money, I wore nice clothes, I drove fancy cars, and so by day, I'm a hero, I'm a young guy in the community speaker, truth to power, let my people go. And then I come home from protest to get calls from bill collectors. You know I was living above my means, I was using credit cards to look good on the outside, and you know my dad died when I was 24. He was 47 and my mother was 44. And when my dad died I was. I was pretty famous for a young guy, but I was broke. I wouldn't. I could not have bought my mother a hamburger to help her survive after my dad died, had he not had insurance. I don't know where she'd be.

DeForest B. Soaries Jr.:And so, from the time I was 19 to the time I was 31, I was really searching. I was pastoring a church Langston. I was teaching people to tithe 10% of their income and I couldn't do it myself because I was too busy spending money on things that made me look like a preacher instead of me saving like I had some good sex. And so, when I was 31, my grandmother died. My father's mother died when she died Sixth grade education, six children with a husband who was an invalid, who couldn't work to support her.

DeForest B. Soaries Jr.:She's so close for a living, but she died with three houses paid for and one of those houses she left to me. And so the first house I own was inherited by my grandmother. And I looked at my life and I said look, my grandmother had no education, no civil rights, no husband to support her. Yet she died a wealthy woman. And here I am with college degrees, newspaper clippings.

DeForest B. Soaries Jr.:I've been all over the country preaching and I am broke, and I decided that day I had to change my life. I had to continue fighting against injustice, but I had to stop spending money on things that look good but have no value. I had to get rid of my nice bachelor's apartment. I had to sell my luxury car. I had to sell all that furniture, get rid of these credit cards and start living within my means and paying my bills on time, stop fighting with bill collectors and paying high interest rates and late fees. And I had to start living within a budget.

DeForest B. Soaries Jr.:Now it doesn't sound revolutionary, it doesn't sound sexy, but one of the realities about black America is that so many of us are living the way I used to live that we wouldn't have Listen, we wouldn't have an HBCU, we wouldn't have a civil rights organization, we wouldn't have any of the black institutions that we say we care about. It's a work of white people. Black Lives Matter would have to shut down if they depended on Black dollars. Yeah, white money keeping black lives matter Functionally. Now, I'm not against white money. I think it's hypocritical for me, for me as a Black pastor. I was a black activist. I could not donate a quarter to NAACP United Negro College Fund. When you talk about the scholarship we gave you at First Baptist, that's all black money. That's right. Black people deciding that they're going to take money that they could spend on themselves and put it in a scholarship fund so we could help young guys like you, and that's something the government can't do. The government can't do for us, that's something we have to do for ourselves.

DeForest B. Soaries Jr.:So when D- Free came along, it came along when I discovered that I had to basically give away my strategy 2005,. We're in New Jersey, at the church that you described, and many of our members were making a lot of money, but they were driving luxury cars, they had high credit card expenses, they bought houses bigger than they could afford, and we decided that it was in the best interest of the church to focus on the members' financial status and make it more important than the need that the church had for money. And so we just went after it, and what I did was I took my experience after my grandmother died and I turned it into a program and said look, when I was living like you, people are living. Here's what I did. I wrote it down, I wrote a book, cnn came along, put us all to a blast and now, 16 years later, we have paid down over $31 million in consumer debt.

DeForest B. Soaries Jr.:We've trained over 5,000 churches to use our curriculum and our strategy. We have over 250 chapters of Delta, sigma, theta, sorority using our curriculum for their members and communities and listen. We're just getting started. We're getting ready to launch a podcast network with various personalities doing podcasts that focus on. One of them focuses on women understanding the finances so that, when their husbands die or leave, they're not stuck in poverty. We've got one that's going to be focused on sports and money. We've got another one that's going to focus on successful black businesses, the way you do, and we're just putting together a deep, free podcast network. We'll launch that in July.

DeForest B. Soaries Jr.:So we have a lot coming, but at the core here's the core there are good we call them good deeds and bad deeds. The good deeds are the deed of depositing money in your own account right and letting it stay there for a while. A good deed is having your name on a deed because you own some real estate. And a good deed is earning dividends from investments, making your money work for you instead of you working for money. The bad deeds are debt, delinquency and deficit. The bad deed is paying 60% interest on a credit card, paying $35 late fees because you're always delinquent and living above your means. And if we can get rid of the bad deeds, then we can enjoy the good deeds.

Langston Clark :I, um, I, I have these debates with my friends all the time. Uh, people who in my circle they know me as the cheap one. Um, I was the last person to get a smartphone. You know everybody's telling me to get a new car. I lived in an apartment with no furniture for like two or three years so I could pay my student loans off. That's right. I had a roommate when I was like in my early thirties as a college professor, because in my mind I was going to save up and buy a house with no debt.

Langston Clark :So I hear all of these, all of these you know voices. Some people are like yo, you'll always be in debt. There's no way you can never be in debt. There's other people who are like it's suboptimal for you to not just go get the loan and get your house now with the way the interest rates are. And it didn't work out that I got a house debt free. I'm wondering, like I've just posed a question like this would black people as a whole be better off if we committed just hardcore no debt period or just, in some instances, decided that here's an instance where I would get some good debt? You know I mean. So how do you feel about like the hardcore no debtors and some people were like this debt could actually lead to a greater outcome.

DeForest B. Soaries Jr.:I don't believe in no debt at all. I'm against debt that is created to support a lifestyle that you cannot afford. That's what I'm getting and that's the kind of debt I had. I made $25,000 a year, but I had a credit card with a $5,000 spending limit, so I lived as if I earned $30,000 a year. So that's bad debt. But I recently sold a apartment building. I owed $2.5 million to a bank on a building that was worth $4 million. Every month my tenants paid me rent and I took the rent money to pay off the mortgage. When I bought the building, it was worth $3.7 million. So where did the $1.2 million in equity come from the tenants? So when you have other people paying off your debt, that's good debt. So I sold the apartment building. Now the money's in my bank account. So debt to be used strategically to create wealth, that's good debt.

DeForest B. Soaries Jr.:Bad debt is debt used to support a lifestyle, to buy a BMW when you could really only afford a Toyota Debt. To buy shoes with red bottoms when brown bottoms are probably even more comfortable. You know, get to change the color of your hair every three weeks when you're not impressing anybody with blonde hair, red hair and then braids. So, like I said, I'm not against all that would be Dave Ramsey. He's against all debt, all of that. Of course, now that he's a multimillionaire, he's against all debt. Debt should be used strategically to create wealth. Debt used to support a lifestyle that makes me look good, even though I own more money than I own, that's bad debt. So I'll put it to you this way Suppose I told you that I could guarantee you, you give me $10,000 and I could guarantee you a 16% return on your money. That's a great return. That's great that every year you'd make $10,000, would make $1,600 just by sitting there. Well, I can guarantee you a 16% return by paying off a credit card that has 16% interest. Right, you know I'm involved in two public companies and people ask me about buying stock because both of my companies, the stock was doing pretty well and I've made a decent amount of money in the stock market. But the best investment, the best investment, is to pay off interest rate on credit cards and on cars. I mean, one of my young friends told me today that they have a car loan and it pays 16.9% interest and I'm telling you it doesn't make sense to buy a stock 9% interest. And I'm telling you it doesn't make sense to buy a stock. A good stock I mean a great stock will give you 8% to 12% return. That's still not 16% to 24% that you pay on credit cards, and so it's a matter of it's changing our minds.

DeForest B. Soaries Jr.:You know, you were the last person to get a cell phone, a smartphone. I was the last person to get a cell phone, a smartphone. I was the last person to get a flat screen TV. A church member, one of our church members, stopped by the house one day and they walked in our TV room and they were offended and they were like you don't have a flat screen TV. I said no, mike, this TV works just fine. And they said well, I can't believe it. So I said well, listen, if you don't want me to have a flat screen TV, that badly, you go, give me a flat screen TV. Yeah, you know, they went out and bought a flat screen TV, but listen, I didn't buy it. Yeah, oh it's.

DeForest B. Soaries Jr.:We have to change the way we think. I was reading about a celebrity I can't think of which one it was, but that celebrity said that they don't fly private planes. Well, missy Elliott was the first person to say they don't fly private planes, and I don't even think they fly first class, because some celebrities know that you can be real famous today and in three years. People ask you didn't you used to be so and so? So we have to change the way we think. We have to stop thinking that being dressed up on the outside and looking wealthy is equal to being wealthy, right?

Langston Clark :I think the point that you made about the 16.9% return on an investment is important. I think in, in, in, in the younger culture now, everyone's big on getting into the stock market. Starting a business, earn your leisure is like blowing up. On the one hand it's it's almost, I feel, like it's bigger than a breakfast club. Culturally it's as big as the breakfast club, but then on the money side of conversations it's getting to be as big as Dave Ramsey's and I think they give great strategies and great insights into building wealth.

Langston Clark :But what you just said, I think to me is the first time anyone has sprang. Getting out of debt on something that is a high interest rate is actually a better investment than going into the stock market. And sometimes we need to sit back and just do the math right, because you could be hustling backwards making all of these investments if you have all of these debts. And since you brought up Dave Ramsey's and whatnot, and before we get into the 12-step process, can you talk a little bit about the importance of these conversations being culturally relevant to Black people so that we can maximize their usage?

DeForest B. Soaries Jr.:Yeah, one of the things that I'm very proud of is that our curriculum, our content, is culturally relevant. And here's what I mean by culturally relevant. We borrow heavily from the narrative of our history. Give you a good example At Shaw University there is a chapel on campus, beautiful build. It's where freshman orientation takes place, it's where religious emphasis week takes place, there's a lecture series, and it's called the Thomas Boyd Chapel.

DeForest B. Soaries Jr.:Thomas Boyd was the pastor of Sailing Baptist Church in Brooklyn, new York, for years and when he was 93 years old he came to hear me speak in the chapel that bears his name. Now, mind you, I had spoken there 12 years in a row and I always thought that the person whose name was on the chaplain was dead. I didn't know Thomas Boyd was still alive until that day he came to speak. We went out to lunch and I said to him I said, dr Boyd, let me ask you a question how did you manage to get them the name of Bill Lee at Shore University? Why are you still alive? Because you know, buildings are normally named after people when they die. He said well, it may have something to do with the fact that I gave them $500,000 to build the building. So I said to him well, wait a minute. You know you were a Baptist preacher. I didn't read anything else about you other than you being the pastor of Salem Baptist Church. I'm the pastor of First Baptist Church.

DeForest B. Soaries Jr.:I don't make that kind of money that would put me in a position to write a check for $500,000. How do you do it? He said, listen, when I first started as a minister, every time I do a wedding, every time I do a funeral, every time I get a speaker somewhere, I would get paid and I wouldn't spend the money. And he went on to explain. I put the money in a separate account and the child got too big. The bank called me and said Reverend, you know you've got too much money in this account. You need to let us help you invest the money. And he said and it just grew and grew and grew, year after year. And he said finally, I came back to Shawan University, from which I graduated. I saw that the chapel had been destroyed in a storm and my heart was broken. I took out my checkbook and I just wrote a check for $500,000. Now this is a lesson in our curriculum.

Langston Clark :Yeah.

DeForest B. Soaries Jr.:And what I'm saying to black people, black preachers, black Christians. Here is an example of what we can do if you're willing to make some extra money and not spend it. I was at a point in my life where every time I gave a speech or did a wedding or you know, they gave me some money, I'd spend it. In fact, sometimes I'd ask to be paid in cash because I wanted to spend it that day Right, and that day, having lunch with Dr Boyd changed my life and I started doing the same thing. Every time I give a speech, every time I do anything that gives me extra cash above my salary, I don't spend it, I put it somewhere and now I'm in the same kind of position that Dr Boyd was in and that's in my curriculum. You see, when you have a history like ours that is saturated with bad news, I mean we just. We just marked the 100th anniversary of the racial massacre in Tulsa, oklahoma. We'll celebrate Juneteenth on Saturday. The fact is, black people have had to endure some of the toughest experiences any human in any country at any time in history. But the fact is, here we are, we have been resilient, we started churches, we started colleges, and so our curriculum draws on the strengths and the successes and the resilience of Black people and, I believe, your generation. If you really really are taught how profound Black people have been, then you'll pick up the mantle, use the examples and you'll say to yourself listen, of course racism is alive today, but it can't be as bad as it was 100 years ago. And if they could do what they did 100 years ago, what is our problem today? So cultural relevance is absolutely critical, and that's what D-Free is.

DeForest B. Soaries Jr.:D-Free is biblically based. I'm a preacher. It's culturally relevant and it's affordable. My book only costs $10. $10. My workbook costs $10. And our online academy is free. Free Doesn't cost anything. You can sign up right now, you can register for the course, you can start taking the course. I walk you through my book online for free, I tell some stories, I give you some suggestions and their worksheets, and it's all free. We have raised money to build a platform that we can give to black America for free.

Langston Clark :And I think that's amazing because when I read the book and I went through the program, when I heard the story of Pastor Boyd, it made me think of the fact that I was reading the book, going through the workbook in a black church, learning about a black preacher these are all black institutions who used his platform in a black institution to support another black institution. And I think part of the part of where I hope we go as a group of people is to think about our finances, not just about as enriching us and getting ourselves out of debt, but also thinking about the value of philanthropy. I don't mean charity, I mean philanthropy. Does Institutions change policy? They change curriculum in K-12 schools. That's what really empowers most people. So I thought that that was a powerful narrative, but then also, in a lot of ways, planted seeds for something bigger than just our own personal economic liberation.

DeForest B. Soaries Jr.:Langston, you know I don't talk about this a lot, but one of my other motivations for launching D- Free was that I just got tired of watching preachers on television talk about money as if the ultimate goal is to spend it on yourself. You know some of these people I grew up with. I knew these guys. And to think that God wants you rich so that you could drive a Rolls Royce and look rich, that's blasphemy. And so if you notice in the process and what we call our curriculum, there are four levels. Level one responds to the question I get more than any other question how do I get started? You know I've got debt. I've got student loan debt. My mother's sick, I've got hospital bills. You know how do I get started?

DeForest B. Soaries Jr.:For the person who is stuck and to your previous point, you may not be stuck in poverty. You could be stuck just living paycheck to paycheck. Living paycheck to paycheck is stressful. It is Especially when you know that if you miss two paychecks, you've got no savings, you've got no assets, you've got no strategy. If your company goes out of business or you get laid off for some other reason, living paycheck to paycheck is stressful.

DeForest B. Soaries Jr.:So if you're stuck, the first question you want to know is how can I get started to get to the next level? How can I get started? So that's where we start, and most of the answer to that question is mentality. It's admit the problem. Whatever problem you know, whatever you know, my problem, even after I started making money, was chaos. I was disorganized and sometimes just chaos is a problem. Sometimes a lack of focus is the problem. But the first level is get started. And you start by looking at yourself and asking yourself the tough questions. Not you know how bad was slavery or how crazy is the president? No, let's start with when was the last time you balanced your checkbook? You really need to spend five dollars a day at Starbucks, twenty five dollars a week? You really need to pay someone to wash your car for free when the water at your house is just as wet as the water at the car wash? These are basic things. So then the next level is get control.

DeForest B. Soaries Jr.:A young actress called me from Hollywood and said sorry, listen, I need to help with my credit cards. Who do I call? What do I do? And I said well, listen, I need to help with my credit cards. Who do I call? What do I do? And I said well, how much credit card debt do you have? And she said I don't know, just lost control. Wow, and so by getting control, when we get control, that's when we start looking at what we have.

DeForest B. Soaries Jr.:You know, my motto, like I said, is the only thing worse than not having what you need is not using what you have. Many of us have assets, many of us have opportunities that we don't take advantage of. So that's the second level, and the third level is once you get started and take control. The third level is get ahead. How do you get ahead? How do you do some investing? What kind of insurances do I need to protect the assets that I have? You know, what kind of business could I start? What kind of side hustle can I create to increase my income?

DeForest B. Soaries Jr.:But the fourth level is the level that you're describing. The fourth level is give back that financial freedom. That does not include giving back teaching others what you've learned, becoming philanthropic to causes that are important. That's not freedom at all. And you know, in the curriculum that's how I describe Harriet Tubman.

DeForest B. Soaries Jr.:Harriet Tubman decided that the gift and blessing of her freedom from slavery required that she go back into slavery to bring people out. And so, you know, god blessed me to live long enough to outgrow my lifestyle where I was wasting money instead of saving money and I couldn't give anybody anything. Now, any cause that I care about, I can write a decent sized check and make a difference. And so my assets have been accrued and developed to position me to serve and to say you know, I am the pastor of the church, but I'm one of the top givers at our church Because I believe in giving back. So financial freedom is epitomized by giving back. If we're not giving back, well, we're still slaves. We're not slaves to debt, but we're slaves to possessions. When we worship our possessions so much we can't part with them. To give back, yeah.

Langston Clark :So I want to. We may have already sort of like hit on it, but I listened to the to the D-Free podcast. Can you talk just a little bit more about just impacting the culture broadly, like how do we make D-Free a broad mentality among Black communities?

DeForest B. Soaries Jr.:Well, first of all, it's people like you that are going to impact the culture. More than people like me, people have a tendency to listen to people in their circles, in their age group, in their generation, and so one of my goals is to stay as connected as I can to young people. My staff is young. I'm doing special events with people like Shira Sheard, gospel artists and other entertainers. We're talking to a people like Shira Sheard, gospel artists and other entertainers. We're talking to a number of entertainers. Our board of directors at our foundation consists of mostly young people.

DeForest B. Soaries Jr.:And then we have to use media. You know the EYL crowd uses media. They're affected. But I think the most important and most impactful strategy that we can use is personal testimonies. We had a young 24-year-old in our church give her testimony that two years after graduation she had paid off all of her student loans. And when a 24-year-old says that, a 26-year-old says well, lord, how'd she do that? Says that A 26-year-old says well, Lord, how'd she do that? But I think the best way to impact the culture is by people your age and your generation going through the program, taking advantage of the resources and then telling their story. And so we're building a studio right now, right there. You know where the old post office was on Franklin Boulevard in Somerset. That's now our building.

Langston Clark :Are you sure you're retiring?

DeForest B. Soaries Jr.:Well, yeah, I'm retiring from the church. Okay, all right. So this right, you see all of this behind me. That's the old post office, and these are offices where the deep free work happens, where the ideas come from, our offices, where the D- Free work happens where the ideas come from. And in the back we are building a studio and in that studio we're going to create multimedia, we're going to create videos, we'll create curricula, we'll create music, hip hop, gospel all designed to create influencers and influential tools to reach new generation.

Langston Clark :Right, that's amazing, and so I bring up the retirement because it's like you've done it first, baptist, but it's like there's all of these other things that you are interested in doing and I don't. I don't necessarily look at people who are older as if they are relevant to the culture because, like to me, you're an example of like what I want to be when I'm your age. Right, because, like you're what I'm aspiring to be in terms of when I'm done working in a university setting, want to be able to do my own thing to impact the culture. And maintaining good financial status and having good investments allows you to be in a position that when you retire, you can still have some good work to do and um, and I and I appreciate that- Um, well, you know, a lot of preachers don't retire because they can't afford to, so they hold on to the church.

DeForest B. Soaries Jr.:They get too old to function. The church dies. All the young people leave. By the time the preacher dies. The church is dead. Our church is stronger today than it's ever been. Spiritually, functionally, programmatically, financially. Our church is stronger today than it's ever been and that's why I'm leaving, because I want to leave while things are going well.

DeForest B. Soaries Jr.:But there's a big world out there. Listen, lex, and very few people know this, but I'll break it on your show. I have about 50 hours of footage on two African chains today, one in Ghana and one in Uganda, and that footage is the beginning of a documentary series called African Royalty. Today, you know, we often talk colloquially about we used to be kings and queens in Africa. We are kings and queens in Africa today. That's right. They are royal families. So when the media says the royal family, they're talking about the royal family in England, but there are royal families throughout Africa, many of whom are doing some very important developmental work for young people around health care and education. What I want to do is a documentary series that puts the spotlight on African royalty, and that's that's my pet project. When I leave First Baptist on June 30th. On July 1st I'll be sending packages out to Netflix, smithsonian, hulu and other platforms to get a partner that can put these raw fabrics on full blast. I want the world to see black royalty and black excellence, absolutely.

Langston Clark :That's amazing and I never thought about that that way either. Right, we always think about the kings and queens as past tense and never what's going on. Right now we're talking about different. What do you teach? What do I teach? So I teach a lot of things.

Langston Clark :So the primary class that I teach is called Adapted Physical Activity, which is basically how to teach and work with individuals with disabilities and physical activity. So it could be sport, it could be working out, whatever. And then the other class that I teach most recently was called African Americans in Sport and we actually made it a pod class. So we got a whole bunch of guest speakers come in and talk and me and my homeboy, brandon Crooms, who was teaching at the University of Texas at Austin, and another homeboy, alvin Logan, who was teaching at the University of Texas at Austin, and another homeboy, alvin Logan, who was teaching at Seattle University, just kind of collaborated to get these figures to come.

Langston Clark :Some people from the NFL, some former student athletes, some people working at ESPN, some counselors, some psychologists all different ranges of expertise came and recorded videos and we'll actually be launching that sometime in September for those of you who are joining us today. So that's, that's pretty much what I do at the university, but I'm also really involved in the community here in San Antonio with some other things as well. So Excellent, excellent, I'm proud of you, thank you, thank you. And I used to be I used to be an elementary school physical education teacher, and so we've talked about, like all different age ranges, older people, people in the middle of their careers, people coming out of college, but how do we get the, how do we get the D-F ree message out to our young, youngest, the youngest people in our community?

DeForest B. Soaries Jr.:Yeah, I had an intern last summer from Howard University who put together for us a strategy for a D-Free video game. We want to create a video game where young people are playing the game but not realizing that while they're playing, they're being taught about finance. Wow, we have. We have the first generation of content. We call it D-Free Young Money for older youth, and we have six segments. We have a video with conversation and then worksheets and discussion guides. We're going to update that and expand it, but we want young people to help us create the content for the young people. No need an old man like me trying to create content for nine year olds. We're also looking at partnerships.

DeForest B. Soaries Jr.:Believe it or not, there are some significant efforts being made, most of them small, to teach young black people about money. You've got authors writing animated series, you've got games, board games, and so one of my objectives is also to partner with other people. If I find someone doing good work, we can form some kind of strategic partnership. We don't have to create everything ourselves. We can use our resources, platform our resources and our network to promote content that teaches the same principles but does it in a slightly different way.

Langston Clark :Yeah, there's a mentor of mine that lives here in San Antonio. His name is Dorian Williams and he's a pastor and he's almost like a younger version of you. When I see him I think about you, because he's the pastor of a church. He just bought a co-working space called the Moad Centers and it's full and it's got tons of diverse entrepreneurs working in that co-working space. But then he's also established this program called the Greenwood Program and it's a nonprofit that helps Black folk figure out how to start their businesses.

Langston Clark :You know, because I look at, I look at D- Free almost like a spectrum and I'm and I've heard you say this on a podcast before Right, so you've got to pay your debts off. First, the 16 percent interest rate on a credit card versus the 8 percent you might get in the stock market. Interest rate on a credit card versus the 8% you might get in the stock market. So that's step one the debt, then the investments, then maybe the entrepreneurship and then the philanthropy. And I think he's more at the end of the spectrum with the philanthropy and the business part. But I think that's the whole beauty of the D-Free movement and that's what I think makes it a bit more culturally relevant to us, as opposed to Dave Ramsey's, who stops it just getting out of debt, because we need to build institutions and we need to build businesses that serve our communities and and serve them well.

DeForest B. Soaries Jr.:So you know we've done. We have. We have our core curriculum, which you have right behind me. Say yes to no, it's a book of the workbook. But then what we've done Langston, because of the experiences we've had, we've created what we call supplements to the core curriculum.

DeForest B. Soaries Jr.:We have a supplement for young adults. In other words, if you're a young adult, here's how these principles probably apply to your situation. We have one for senior citizens. You know, if you're 75, D-Free means something slightly different than if you're 25. So we have a supplement for seniors.

DeForest B. Soaries Jr.:We have a supplement for entrepreneurs and we piloted that in oh God, I forget in Mont Modesto, one of the cities in California I'm tired, I've been up all day the Black Chamber of Commerce organization of 300 black business people, Fresno, in Fresno, California, used our D-Free curriculum and the supplement to fulfill a grant, actually to do technical assistance for black businesses. Because, you're right, just being debt free, that's just the beginning. We describe that as kind of getting up to zero. Ultimately, black America is not going to do well until it embraces the model in America and that is, create small businesses. The majority of the jobs in this country are created by small businesses and Black Americans, I think, have had some apprehension about starting our own businesses for all kinds of reasons, I mean, and all of them are valid. But we've got to crack the code on teaching our people that entrepreneurship is really the ticket for massive economic uplift, and we used to know that.

DeForest B. Soaries Jr.:Listen, that's what Greenwood was about. Right, when you look at Tulsa and look at the massacre what white people did, because when the government just ran the Indians off their land, they literally had a land giveaway in Oklahoma, and so Oklahoma was a place where white people, black people, they rushed and it was almost like a race. They fired the gun and you just went. You could literally go find yourself some land and it was yours. And so that's why we have all these little black towns Leinster, oklahoma, and we had Greenwood, section of Tulsa. But the thing that the massacre happened in 1921. That's right. The community just started forming around 1908. That means that 13 years black people owned 1,000 houses, 300 businesses, they owned a theater, they owned a hotel, six black men owned their own private planes in 13 short years, in just a couple of decades after slavery. So when you look at that you say to yourself, by God, if blacks in the early 1900s can develop that much wealth that had drawn white folks insane. Imagine what we could be doing today. That's right.

Langston Clark :And think about that and I like what you said about your grandmother is that she had no civil rights. About your grandmother is that she had no civil rights Like these black folk in 1921, 1908 in Tulsa had no civil rights Right and they still built what they built.

DeForest B. Soaries Jr.:Yeah, I think in the post civil rights era, I think in many ways we've been lulled to sleep. You know, it's almost as if we were stronger when the opposition was more explicit. Now we know that racism is alive now, but they're not lynching us downtown. They are shooting us from time to time with badges, which is a different kind of racism. But racism you have to. You cannot say that racism is as blatant today as it was then. It's not as intimidating. You know what?

DeForest B. Soaries Jr.:Listen, I grew up in Jersey. I grew up in a town called Montclair, but I grew up in the black section of Montclair and there were certain sections in our town we knew we didn't go to. We didn't go to certain parks. We didn't go to certain parks, we didn't go to certain businesses and the town right below us, Glen Ridge. Every Black child that was raised in Montclair knew don't get caught on Glen Ridge after dark. This was just our reality.

DeForest B. Soaries Jr.:So if we could become who we are in spite of that, then today the only barrier we really have ultimately is us. We're certainly going to find some white people, some carries that's going to call us out of our name period. We're going to find some white institutions that really aren't excited about diversity and hiring us there. But there are so many opportunities that do exist that we need not hang our heads down and give up because we get one insult or one closed door. There are too many. Look at Oprah, Oprah weren't? You? Face racism, but it didn't stop her from kicking Phil Dolly you off the air. You're the first black female billionaire in the country. So that that's my message, and I think D- Free incorporates all of my philosophy. I believe in fighting injustice, I believe in standing up to racism, I believe in fighting for better policies, but there's some things we just have to do for ourselves.

Langston Clark :Fighting for better policies, but there's some things we just have to do for ourselves. Yeah, for sure, pastor Stories. So I've talked about, like, the spectrum going from getting out of debt to building wealth, to philanthropy. We've talked a little bit about building our own businesses, but I also noticed that you have a masterclass for becoming a corporate board member, so could you talk a little bit about how that fits into, maybe, the economic freedom narrative of black America?

DeForest B. Soaries Jr.:So I'm on the board of a few corporations. I'm in a position, as a result of that, to guide their policies in terms of how they interact with Black businesses. I'm in a position to advocate for Black professionals and to ensure that they're treated with respect. I'm in a position to interact with other Blacks that are on corporate boards, and we trade notes about how corporate America can have a different kind of relationship with Black boards, or we trade notes about how a corporate America can can have a different kind of relationship with black people. And so you know, I think after the civil rights movement, we put so much emphasis on politics that we failed to recognize that the political table is not the only table that has seats, and so when we talk about having a seat at the table, we generally are referring to the political table. But I have more influence in certain spaces as one Black man on the board of certain corporations as many Black politicians in Jersey.

DeForest B. Soaries Jr.:Now it's an inside game. 85% of the corporate directors in this country become corporate directors through personal contacts. So it's not like you can respond to a classified ad. It's not like they're going to come to your college and recruit you to be a corporate director. There's a strategy for becoming a corporate director and since I've been on eight boards that pay me, I know a little something about how to do it, and so I'm taking my 25 years of experience and I put it into a course and I make the course available, and once a month I have a kind of a live coaching session for all of my participants and I'm teaching them how to identify opportunities and then secure seats in corporate America.

Langston Clark :Fantastic, I'm going to take that one day. So we do have a question from an attendee in the Q&A and they're asking where does one start when multiple debt has defaulted? Where does one start when multiple debt has defaulted, filed in civil court and now standing in garnishment for any city or state job?

DeForest B. Soaries Jr.:Well, you know what this anonymous attendee has already started? Just asking the question is the beginning. Listening in on this conversation is the beginning. Listening in on this conversation is the beginning. When I got started, the first thing I did was I started listening to radio programs about money. I was a big radio guy and I loved Urban Radio, wdls. I loved FM R&B. Well, I learned that if I go from FM R&B to AM talk, I could learn so much about money, and so I was commuting between Jersey and New York for work. I was listening to about an hour a day about money and it changed my life.

DeForest B. Soaries Jr.:So the first step is this participating listening to this kind of conversation, because if you get one good idea that you didn't have before, it can be life changing. And then the second is to use a guide. I mean, I I have in my book. I tell my story and it was not me, it's somebody else. I've always learned. You know that if you can find someone who is what you want to be or who has done what you want to do, and they're willing to give you their strategy, that's gold.

DeForest B. Soaries Jr.:Now I give away my strategy in a book form because I don't feel like traveling all over the country talking with one person at a time. A friend of mine in Jamaica has a slogan that says an ounce of ink make a million things, and I never forgot that. He told me that in the early 80s, and so what I do is write books. But there are plenty of books and there are plenty of people.

DeForest B. Soaries Jr.:John Hope Bryant has Operation Hope. He's a great resource. You can find him on YouTube. You can read his books. Oh God, there's a book about wealth being a black choice oh, the Black Choice by Dennis Campbell. So all I'm saying is and then you got to get started. You have to write down all of your challenges. You have to develop a strategy. If you're drowning in debt, you know, I agree with Dave Ramsey on this you pay off your smallest debt first, and then you're next to your smallest and you work your way up to your largest. You go online you can take my course for free and get all the ideas. You can get all the free stuff you can first it's a lot of free stuff out there and ask for help when you need it and so, uh, another.

Langston Clark :another question that I have is, as someone who works in in higher education, if there's, if I'm, if I'm recruiting students to come to the university that I work at and they're like I'm not doing student loans, how, what do you say to like these incoming, this incoming generation of college students with regard to their student loans and student loan debt?

DeForest B. Soaries Jr.:Well, we encourage people like them first of all to work. Get a job. You know there's nothing wrong with having a job. Work, that's number one. Number two go part time. You know, only 20% of the college students in America graduate in four years. Only 20%. That means that most of us like me that go to school full time, we're not going to graduate in four years anyway. So why don't you stretch it out to six years even and go part-time in the fall and the summer and work and pay as you go? There are plenty of options to take out big student loans. Go to a junior college for two years and then go to a four-year college. Junior college is much cheaper than a four-year college.

DeForest B. Soaries Jr.:Apply for scholarships. We have a young lady called the college girl that grew up in First Baptist. You may remember Jessica Brown. She's around your age. Jessica wrote a book on how to pay for college if you're broke, and Jessica talks about the hundreds of thousands of dollars in scholarship money that no one ever applies for. Do your research. I met a woman in Chicago a few years ago. She had three children and all of them went all through college with scholarships because she made it her full-time job, find the scholarships, so working going, part-time, community college and scholarships that's a good place to start.

Langston Clark :That's good. And what do you say to the person who's recently graduated, who is maybe? Yes, I'm going to tell you what I think. I don't think the government is going to bail everybody. Everybody's still loans out. I just, I just, I don't see it happening. And so what's the wake up call for people who are waiting for the Biden administration, or whatever administration that's coming next, to make them realize that you just need to pay your loans off?

DeForest B. Soaries Jr.:Yeah, it's not going to happen. You can see what's happening in Washington now. You've got Democrats that don't even support the Democratic president's initiatives on things that will help their own constituents, and so, no, the way you deal with your student loan debt is you pay it off as quickly as you can, in other words, every penny that you don't have to spend on something. You don't need car washes, you can wash your own car. You don't need Starbucks. Listen, I went from Starbucks to Dunkin' Donuts thinking I was being heroic. Right, you eat from $5 to $2. I stopped going to Dunkin' Donuts. I make my own tea. I buy 24 tea bags for just $5 or $6. I make my own tea. I buy 24 tea bags for just five or six dollars. I make my own tea.

DeForest B. Soaries Jr.:I'm saving big money not going to Dunkin Donuts and I have money, and what I've learned is that the more money I get, the less money I spend. The more money I have, the more money I still keep it. So what you want to do, if you just graduated from connells, you want to give yourself a deadline for when those student loans have been paid off. Now the problem, likes that we have for those in school, is that often we take out more money than we need. We borrow more money than we need. So we borrow some to pay tuition and some for lifestyle.

Langston Clark :That's right.

DeForest B. Soaries Jr.:And it's so many people do it. We feel that it's normal, but what you want to do is pay as much as you can, as often as you can, on your student loan and give yourself a deadline to pay it off, because your student loan will never, ever go away until you pay it off. Your Jeep died. I've got If you die, I've got people right now. I've got letters, email. I can show you where people have inherited the loans from their parents.

Langston Clark :Yeah, it's not good. It's not good and I would say this as someone who went to an HBCU don't use your refund check to get right for homecoming. It's not worth it. It's not worth it at all. Just get you a job at a clothing store and get you get your clothes right, but don't, don't, don't. If you don't need the money, make sure you don't take it. I do want to ask one last question, so before, before our conversation with you, the last talk I had was with a brother by the name of Isaiah Jackson, and he wrote a book called Bitcoin in Black America, and so I think I saw you had some of there recently or an event coming up talking about cryptocurrencies and things like that. What are your thoughts on this new money that's coming around?

DeForest B. Soaries Jr.:Yeah, I've started the conversation. I have a short conversation with a fintech executive whose company is about to make cryptocurrency available to their members, their customers. Well, first of all, I think cryptocurrency is huge. That's number one. Too many central banks around the world are adopting it. Too many corporate investments are going into it.

DeForest B. Soaries Jr.:Cryptocurrency is, you know, I told some guys the other day said you know what? When rap music first started, we thought it was just a fad. All the old heads you know, especially those of us that were involved in music that's just a valuable way, and now hip-hop rules the world. Hip-hop drives the culture. I think cryptocurrency is the financial version of hip-hop. Wow. And I think cryptocurrency is here to stay.

DeForest B. Soaries Jr.:I think it's very volatile. It's very risky. Right now, there's a big lawsuit between the Securities and Exchange Commission and Ripple because their cryptocurrency is. Well, sec says that it's a security and not a commodity, and so they're fighting. But the resolution of that's going to be critical because Ripple has a cryptocurrency that has a use case. Well, bitcoin, dogecoin, many other coins. They are volatile because they're sketchy. Well, we're not sure where it's going to go, but there are some cryptocurrencies that have a yeast case and what you want to do is look for the cryptocurrencies that have some functional purpose within some enterprise, and that's the cryptocurrency that's most likely to last. But only about 3% of us have enough money to invest in crypto, because right now, the only money that you can invest in crypto is money that you can afford to lose. Most of us can't afford to lose $5. That's right.

Langston Clark :So what I'm hearing you say is that if you have $5,000 worth of credit card debt at 16.9% before you get that Bitcoin, you might want to pay on that credit card.

DeForest B. Soaries Jr.:Or car loan debt, or furniture debt, or rent-to-own debt, or payday loan debt. You know there's a whole lot of debt. In fact, if you ever payday loan, you need to pay that off right away because you're headed for financial hell. That's right. The payday loan is the crack cocaine of the financial services industry.

Langston Clark :It's the devil's bank.

Langston Clark :That's what I think, and here in San Antonio, where I live, we have the highest concentration of payday loans payday loan places in the country, right, right, yeah. And before we go, I want to just give an example of a token that has a usage, pastor Soaries, for people that don't know. So, my wife and I recently got what's called a helium hotspot, and basically what they're trying to do is we bought a cell phone tower that's in our house and it's the size of like a wifi modem, and essentially what this company is trying to do is get people to put them in their houses and create an alternative cell phone network, as opposed to AT&T owning all the towers. And so what happens is, as our helium hotspot gets used, we get a helium token, or percentage of a helium, and so after about a year, the box that we bought will pay for itself and the rest of it will be income. So when we talk about tokens, cryptocurrencies that have a usage, it's attached to something that is actually providing a service and has a function in the society.

DeForest B. Soaries Jr.:That's exactly exactly what I'm talking about. Although I don't have a heel on my spot, should I have one, you should think about it. Are you using it for this connection? No, so it's not talking.

Langston Clark :It's not a wifi routerfi router. You think of it like a cell phone tower. Yeah, and honestly I don't even know if my cell phone picks up on it. I just know that it provides the service like outside of my house. I see what I'm saying. It's like I'm the only one in my neighborhood so I don't make that much money off of it. But if my neighbor down the street had one, my box would talk to their box and if someone on the next street had one, all three boxes would talk. And so as the network grows and the boxes are spaced out at a good distance, you create the network and there's more sort of triangulation among the boxes that provide the service for the wireless usage.

DeForest B. Soaries Jr.:Well, you see, you just answered your previous question. How do we impact the culture? We impact the culture by having stories, testimonies that we can share with each other, and they go viral. Unfortunately, now the culture has become so polluted that debauchery and decadence goes viral first. But you know, at some point people get too tired or too old to just watch Megan Thee Stallion all day long. They're going to want to figure out how they can get paid instead of her benefiting from them watching her. And I think there are a lot of young people like yourself out there looking for concrete solutions to persistent problems and they're not willing to sit back and just accept the status quo. So I commend you on your network and just let me know how we can hook up and when we can do things together and add Thank you for joining this edition of Entrepreneurial Appetite.

Langston Clark :If you liked the episode, you can support the show by becoming one of our founding 55 patrons, which gives you access to our live discussions and bonus materials, or you can subscribe to the show. Give us five stars and leave a comment.